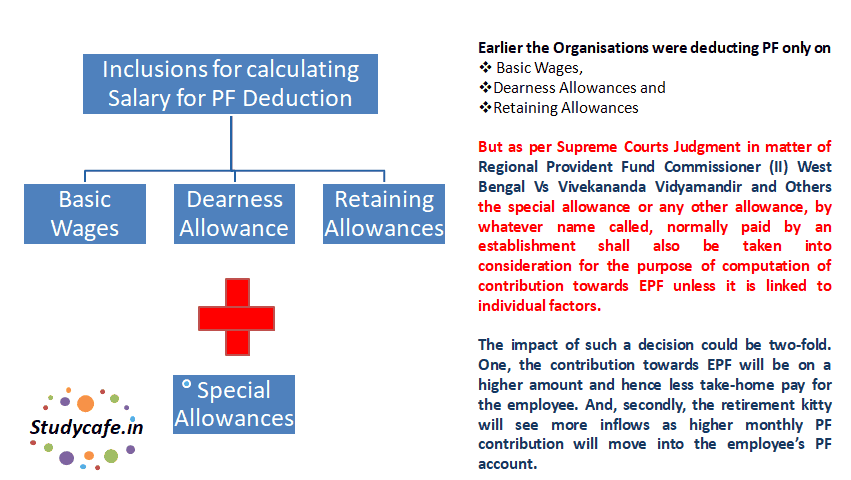

Payments Subject to EPF Contribution. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

The Supreme Court vide judgement dated 28 February 2019 in the.

. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. The employee contributes 11 X RM10000 RM1100 per. Service provider NO Reimbursement for handphone.

For an employed Malaysian below the age of 55 who earns RM10000 a month. In general all monetary payments that are meant to be wages are subject to EPF contribution. 102000 - Total Ordinary.

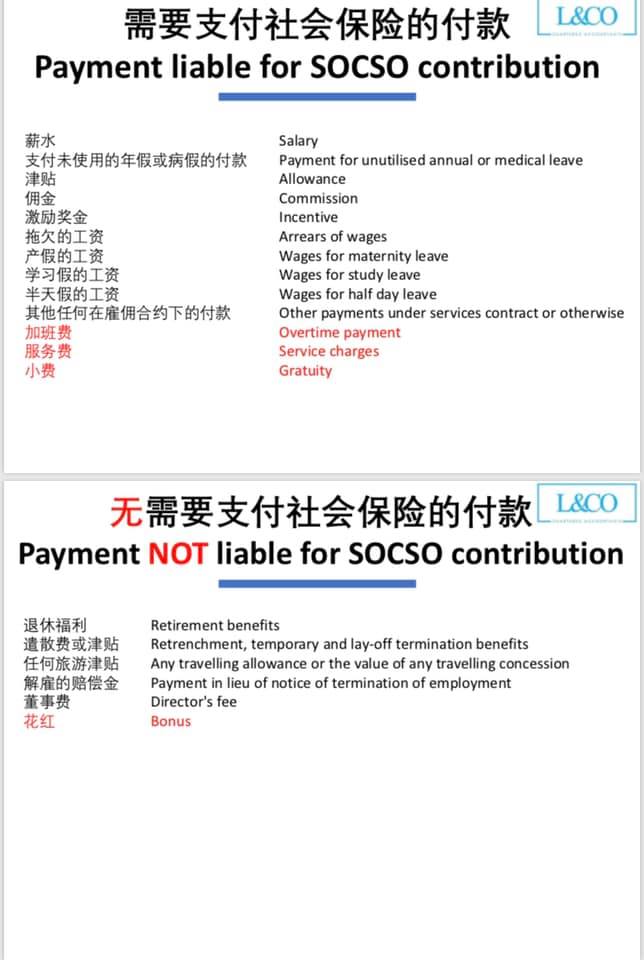

Governed under the Employee Provident Fund Act 1991 EPF is a retirement saving scheme for employees who are liable to contribute EPF in. While the act specifies that allowances are subject to EPF it also specifies an overruling criteria whereby any travelling allowance or the value of any travelling concession. Although 90 of allowances are subject to epf socso and pcb there are quite a number of allowances that do not attract all or some of these statutory deductions.

The payments below are not considered wages and are not included in the calculations for monthly deductions. Hi Aries For any Variable Pay that you. Annual leave sick leave maternity leave rest day public holiday.

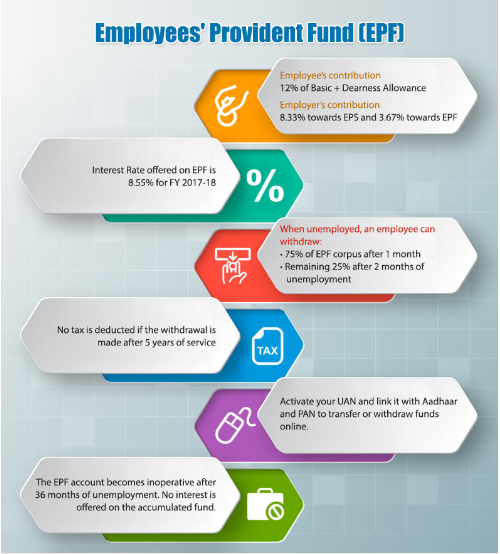

Employers are legally required to contribute EPF for all payments of wages paid to the employees. The current rates are 11 for. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector.

Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF. There has been a long standing dispute on the salary components which are subject to contribution. In general all monetary payments that are meant to be wages are subject to EPF contribution.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly. Among the payments that are exempted from EIS contribution include. Dear Colleague Your Question is.

Retrenchment lay-off or termination. However as the word is broad enough to include payments for food. View more examples of allowances and payments that attract CPF as well as payments that are not considered wages.

See examples PDF 02MB Classification. Payment of handphone and pager allowances to employees YES Payment of handphone and pager charges directly to third party eg. How calculation works.

EPF deduction in leave bonus and conveyance and laundry allowance is mandatory. In short yes bonuses and cash allowances are considered to be part of your wages. Additionally the following list of payments must be included when calculating EPF.

2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 7 The PF authorities issued a circular in November 2012 which inter alia indicated that the term any. Employees Provident Fund EPF contribution. All payments for wages are subject to EPF deductions.

5 years 4 months ago 1041. Any contribution payable by the employer towards any pension or. Replied by Kap-Chew on topic PetrolFood Allowance is part of EPF Contribution.

Can any one provide Include and exclude Allowances list. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees. Payments which are not liable for EPF contribution are-.

Payments for unutilized annual or medical leave. The extent of the employers obligation to.

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Job Application Form Math Models

Travelling Allowance Rules Production Of Receipts Vouchers For Reimbursement Of Travelling Charges Deptt Of Post Allowance Communication Department Receipts

Provident Fund To Be Paid On Allowances Sgc Blog Payroll And Compliance

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Payment Of Ota And Ta To Railway Employees By 50 Measures To Reduce Costs And Improve Savings Reduce Cost Ota Cost

Wages Under Employee S Provident Funds Miscellaneous Act 1952 Sbsandco Llp

Railway School Teachers Working Hours And Holidays Vacations In 2021 School Teacher Teachers Holiday Vacations

What Payments Are Subject To Epf Donovan Ho

10 Types Of Employee Payments Apart From Salary That Businesses Need To Pay Cpf For Dollarsandsense Business

Government Payroll Software Streamline Business Payroll

Understanding Recent Sc Judgment On Deduction Of Pf Of Special Allowances

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

Faq On Epf Payment Subject To Epf Jul 21 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii